The Institutes and ITL Innovator’s Edge Survey: Insurance Companies Are Prioritizing Innovation, but Face Technical and Cultural Hurdles to Implementation

Press Releases

Nov 06, 2018

MALVERN, Pa., Nov. 6, 2018 /PRNewswire-PRWeb/ — A new survey of insurance executives found that while most companies are prioritizing innovation strategies in order to remain competitive, they are hindered by misconceptions and assumptions related to legacy technologies, culture, and budget and a lack of skills and understanding. The survey was conducted by The Institutes, the leading education and research provider for the risk management and property-casualty insurance industry, in partnership with ITL Innovator’s Edge, an insurance intelligence platform and advisory specializing in Growth Through Innovation™.

Nearly 70 percent of the 178 senior-level insurance executives surveyed said their company has implemented an innovation strategy, and nearly 90 percent consider this strategy at least a mid-level priority. But the gap between having a strategy and making innovation a top-tier priority is notable. A lack of employee expertise and technical training were also noted as obstacles to success. Only three percent of respondents said that most of their organization’s employees have an adequate understanding of innovation and the skills to be innovative. Further, almost 40 percent of those surveyed cited a need for different talents and skills as one of the largest hurdles to the adoption or execution of innovation strategies.

“New technologies coupled with innovative best practices can vastly improve the insurance experience for many customers, and it’s encouraging to see a strong commitment to harnessing these tools in our industry,” said Peter L. Miller, CPCU, president and chief executive officer of The Institutes. “However, we see a clear need for additional training, education and expertise to help organizations fully leverage new technologies that are capable of cutting costs, reducing fraud and facilitating powerful information-sharing.”

Many of the professionals at the property-casualty, life, surety and health insurance companies surveyed said they are focusing innovation efforts on technology advancements such as artificial intelligence, telematics, Internet of Things capabilities and blockchain. When asked what they hope to achieve with innovation, improving the customer experience and engagement was the most popular response. Other opportunities included driving operational innovation and developing new products and services.

“Disruption is coming to nearly every industry, including insurance,” said Guy Fraker, chief innovation officer at ITL Innovator’s Edge. “However, as opposed to hearing disruption in a negative context, corporate leaders in insurance will be best served by hearing disruption as a proxy for exponential growth opportunities. Innovation has become essential to survival. So not just leaders, but everyone in the industry must become comfortable with new ways of thinking and acquire the skills needed to adapt and thrive in this new landscape.”

The Institutes and ITL Innovator’s Edge will soon launch the first certification program in risk innovation designed to help the insurance industry address its innovation education needs and spark progress. The four-part certification will offer managers, directors and other leaders insights on how to establish an innovation culture and mindset for themselves, their teams and their organization.

About The Institutes | Risk and Insurance Knowledge Group

As the industry’s trusted and respected knowledge leader, The Institutes are committed to meeting the evolving professional development needs of the risk management and insurance industry. We prepare people to fulfill their professional and ethical responsibilities by offering innovative education, research, networking and career resources. Our offerings include the Chartered Property Casualty Underwriter (CPCU®) designation program, associate designation programs, introductory and foundation programs, online courses, continuing education courses, leadership education, custom solutions and assessment tools.

About ITL Innovator’s Edge™

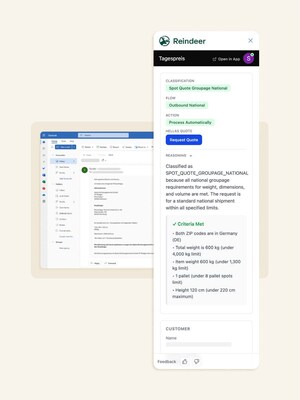

ITL (Insurance Thought Leadership), is a leading destination for insightful thought leadership on the transformation of insurance. Innovator’s Edge focuses on helping companies in the insurance industry achieve Growth Though Innovation™. They leverage the deep relationships developed by Insurance Thought Leadership and bring together an exceptional team to integrate innovation within your business strategy, ensuring that it all becomes integral to your success. Their strategic advisory practice is powered by an intelligence platform that provides members access to 40,000 insurtechs and early stage technology companies across 175+ countries as well as built in research tools and algorithms to identify the best fit.

For ITL Innovator’s Edge press inquiries, contact:

Reet Das

(917) 572-3688

rdas(at)innovatorsedge.io

SOURCE The Institutes