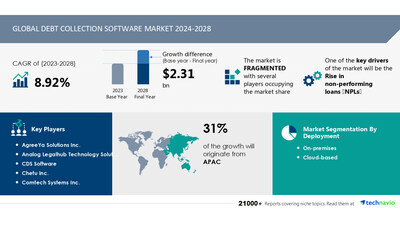

Debt Collection Software Market to Grow by USD 2.31 Billion (2024-2028), Driven by Rising NPLs and AI-Powered Market Evolution – Technavio

Press Releases

Dec 11, 2024

NEW YORK, Dec. 11, 2024 /PRNewswire/ — Report on how AI is driving market transformation – The global debt collection software market size is estimated to grow by USD 2.31 billion from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of 8.92% during the forecast period. Rise in non-performing loans (npls) is driving market growth, with a trend towards integration of advanced technologies in debt collection software. However, high cost of debt collection software poses a challenge. Key market players include AgreeYa Solutions Inc., Analog Legalhub Technology Solutions Pvt. Ltd., CDS Software, Chetu Inc., Comtech Systems Inc., Comtronic Systems LLC, DAKCS Software Systems Inc., Debt Pay Inc., DebtCol Software Pty. Ltd., Debtrak, Experian Plc, ezyCollect Pty. Ltd., Fair Isaac Corp., Fidelity National Information Services Inc., Gaviti Akyl Ltd., Indigo Cloud Ltd., MarketXpander Services Pvt. Ltd., Nestack Technologies Pvt. Ltd., PDCflow, PrimeSoft Solutions Inc., Quantrax Corp. Inc., Radixweb, receeve GmbH, Sila Inc., Totality Software Inc., A4dable Software, Ameyo Pvt Ltd., DBA PaySimple Inc., Simplicity Collection Software, Constellation Software Inc.; CGI Group Inc.; TransUnion; Nucleus Software Exports Ltd.; Pegasystems Inc.; Temenos Group AG; PAIR Finance; Credgenics

AI-Powered Market Evolution Insights. Our comprehensive market report ready with the latest trends, growth opportunities, and strategic analysis- View Free Sample Report PDF

|

Forecast period |

2024-2028 |

|

Base Year |

2023 |

|

Historic Data |

2018 – 2022 |

|

Segment Covered |

Deployment (On-premises and Cloud-based), Industry Application (Small and medium enterprises and Large enterprises), and Geography (North America, Europe, APAC, South America, and Middle East and Africa), Component, enterprise size, end-user |

|

Region Covered |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Key companies profiled |

AgreeYa Solutions Inc., Analog Legalhub Technology Solutions Pvt. Ltd., CDS Software, Chetu Inc., Comtech Systems Inc., Comtronic Systems LLC, DAKCS Software Systems Inc., Debt Pay Inc., DebtCol Software Pty. Ltd., Debtrak, Experian Plc, ezyCollect Pty. Ltd., Fair Isaac Corp., Fidelity National Information Services Inc., Gaviti Akyl Ltd., Indigo Cloud Ltd., MarketXpander Services Pvt. Ltd., Nestack Technologies Pvt. Ltd., PDCflow, PrimeSoft Solutions Inc., Quantrax Corp. Inc., Radixweb, receeve GmbH, Sila Inc., Totality Software Inc., A4dable Software, Ameyo Pvt Ltd., DBA PaySimple Inc., Simplicity Collection Software, Constellation Software Inc.; CGI Group Inc.; TransUnion; Nucleus Software Exports Ltd.; Pegasystems Inc.; Temenos Group AG; PAIR Finance; Credgenics |

Key Market Trends Fueling Growth

The Debt Collection Software market is witnessing significant trends, including automation, multichannel communication, and affordability for organizations of all sizes. Large enterprises segment seeks economies of scale through deployment of advanced debt collection solutions. Services and solutions segments dominate, offering debt collection services and modern applications for effective loan recovery. Implementation of debt collection software involves business-specific needs, training, and implementation work. Legacy systems are being replaced with modern applications for productivity and effective debt recovery. Borrower data, overdue invoice reminders, phone calls, and online payment collection are essential components of the debt collection ecosystem. Banks and financial organizations prioritize debt collection journeys and money collection process, addressing complexities through automation, notifications, alerts, and compliance with consumer protection laws and debt collection regulations. Costs, bankruptcy status, and litigious consumers pose challenges. InterProse Corporation’s InterProse ACE offers debt collection software for government organizations, with components including text messaging, voice mail drops, dialers, and compliance with debt collection regulations. Deployment options include on-premises and cloud-based, catering to enterprise size.

The debt collection software market is undergoing a transformation through the integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and data analytics. These technologies are streamlining debt collection processes by enhancing decision-making capabilities, automating repetitive tasks, and improving overall efficiency. AI specifically, is revolutionizing the financial industry by enabling automated decision-making processes, predictive analytics, and personalized customer interactions. For instance, AI algorithms analyze historical debtor data to forecast payment behaviors and suggest tailored collection strategies, resulting in more effective interventions. This technological integration is a game-changer for the debt collection industry.

Insights on how AI is driving innovation, efficiency, and market growth- Request Sample!

• The Debt Collection Software market faces challenges in automating debt collection processes for organizations, particularly in the large enterprises segment. Affordability and economies of scale are key considerations, as debt collection software solutions must effectively meet business-specific needs without straining budgets. Automation of loan recovery processes, online payment collection, and multichannel communication are essential for productivity and effective debt recovery. Services and solutions segments offer debt collection services and deployment of software for organizations. Debt collection journeys include overdue invoice reminders, phone calls, text messaging, voice mail drops, and dialers. Borrower data, debt collection regulations, bankruptcy status, and litigious consumers add complexities to the debt collection ecosystem. InterProse Corporation’s InterProse ACE software addresses these challenges with automatic monitoring, notifications, and alerts. Deployment options include on-premises and cloud-based solutions, catering to various enterprise sizes. Training and implementation work are crucial for successful deployment and integration with core business systems, such as legacy systems and modern applications. Consumer protection laws and debt collection regulations must be adhered to, ensuring compliance and effective debt collection. Costs, productivity, and effective debt recovery are the primary objectives for financial and banking organizations. The debt collection software market continues to evolve, providing innovative solutions to streamline the money collection process.

• The debt collection software market is facing a significant challenge due to the high cost of the software. This issue poses a barrier for smaller debt collection agencies and businesses with limited financial resources, potentially reducing competition and increasing prices for consumers. The average cost of the software ranges from USD480 to USD1200 yearly per user, with enterprise solutions costing more based on specific requirements. This high expense can hinder market growth and limit access to effective debt collection solutions for many organizations.

Insights into how AI is reshaping industries and driving growth- Download a Sample Report

This debt collection software market report extensively covers market segmentation by

- Deployment

- 1.1 On-premises

- 1.2 Cloud-based

- Industry Application

- 2.1 Small and medium enterprises

- 2.2 Large enterprises

- Geography

- 3.1 North America

- 3.2 Europe

- 3.3 APAC

- 3.4 South America

- 3.5 Middle East and Africa

- Component

- Enterprise size

- End-user

1.1 On-premises- On-premises debt collection software solutions hold a substantial position in the global debt collection software market, addressing the demands of businesses that value internal infrastructure management, data security, and customizability. These software solutions are installed and operated within an organization’s premises, granting users a significant degree of autonomy over their debt collection operations. Large enterprises, particularly those in regulated industries like finance and healthcare, prefer on-premises debt collection software to safeguard sensitive debtor information and adhere to stringent data privacy regulations. Companies such as DAKCS Software Systems Inc. (DAKCS) provide tailored on-premises debt collection solutions, catering to the unique security and regulatory needs of large enterprises. This level of customization is particularly appealing to complex debt collection operations within large enterprises. On-premises debt collection software enables organizations to maintain full control over their data and operations, which is essential for large enterprises adhering to strict IT policies and security protocols. Providers like CDS Software offer extensive on-premises debt collection software, empowering large enterprises to manage their debt collection processes while ensuring data security and integrity. The need for direct control over data and operations, combined with the ability to customize software to align with specific business processes, is expected to fuel the growth of the on-premises segment in the global debt collection software market.

Download complimentary Sample Report to gain insights into AI’s impact on market dynamics, emerging trends, and future opportunities- including forecast (2024-2028) and historic data (2018 – 2022)

The Debt Collection Software market is witnessing significant growth due to the automation of debt collection processes, providing large enterprises with economies of scale and affordability. This market caters to both services and solutions segments, offering debt collection services and software solutions to organizations. The deployment of debt collection software streamlines the loan recovery process, enabling effective communication through multichannel methods. Borrower data management is crucial, and these systems provide features like overdue invoice reminders, phone calls, and online payment collection. Banking and financial organizations benefit greatly from these solutions, increasing productivity and improving the effectiveness of debt recovery. However, implementing debt collection software comes with complexities, including business-specific needs, training, and implementation work. Legacy systems and modern applications must be considered during strategy development. The debt collection ecosystem requires a well-thought-out plan for successful implementation.

The Debt Collection Software market is witnessing significant growth due to the automation of debt collection processes, which helps organizations streamline their loan recovery process and improve productivity. The large enterprises segment is a major contributor to the market’s growth, as they can leverage economies of scale and affordability. The market offers both solutions and services segments, with debt collection services being a popular choice for organizations seeking expert assistance in managing their debt collection journeys. The deployment of debt collection software involves careful strategy and implementation, taking into account business-specific needs and the complexities of the debt collection ecosystem. Modern applications replace legacy systems, offering online payment collection, overdue invoice reminders, and multichannel communication options like phone calls, text messaging, voice mail drops, and dialers. Implementation work includes training and adherence to debt collection regulations, consumer protection laws, bankruptcy status, and litigious consumers. The market caters to banking organizations, financial institutions, government organizations, and other entities, providing effective debt recovery and cost savings through automatic monitoring, notifications, and alerts.

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

- Deployment

- On-premises

- Cloud-based

- Industry Application

- Small And Medium Enterprises

- Large Enterprises

- Geography

- North America

- Europe

- APAC

- South America

- Middle East And Africa

- Component

- Enterprise size

- End-user

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: [email protected]

Website: www.technavio.com/

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/debt-collection-software-market-to-grow-by-usd-2-31-billion-2024-2028-driven-by-rising-npls-and-ai-powered-market-evolution—technavio-302327886.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/debt-collection-software-market-to-grow-by-usd-2-31-billion-2024-2028-driven-by-rising-npls-and-ai-powered-market-evolution—technavio-302327886.html

SOURCE Technavio