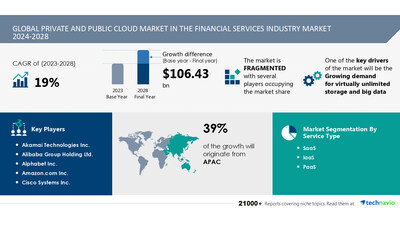

Private and Public Cloud Market in Financial Services to Grow by USD 106.43 Billion (2024-2028), Driven by Big Data and AI-Influenced Market Trends – Technavio

Press Releases

Dec 10, 2024

NEW YORK, Dec. 10, 2024 /PRNewswire/ — Report on how AI is redefining market landscape – The private and public cloud market in the financial services industry size is estimated to grow by USD 106.43 billion from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of 19% during the forecast period. Growing demand for virtually unlimited storage and big data is driving market growth, with a trend towards development of openstack. However, data security and privacy issues in the private and public cloud in financial services poses a challenge. Key market players include Akamai Technologies Inc., Alibaba Group Holding Ltd., Alphabet Inc., Amazon.com Inc., Cisco Systems Inc., Citrix Systems Inc., Dell Technologies Inc., Equinix Inc., Hewlett Packard Enterprise Co., International Business Machines Corp., Juniper Networks Inc., Microsoft Corp., NetApp Inc., Oracle Corp., Rackspace Technology Inc., Salesforce Inc., SAP SE, SS and C Technologies Holdings Inc., Temenos AG, and VMware Inc..

Key insights into market evolution with AI-powered analysis. Explore trends, segmentation, and growth drivers- View Free Sample PDF

|

Private And Public Cloud Market In The Financial Services Industry Scope |

|

|

Report Coverage |

Details |

|

Base year |

2023 |

|

Historic period |

2018 – 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19% |

|

Market growth 2024-2028 |

USD 106.43 billion |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023 (%) |

17.27 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 39% |

|

Key countries |

US, Canada, China, UK, and Germany |

|

Key companies profiled |

Akamai Technologies Inc., Alibaba Group Holding Ltd., Alphabet Inc., Amazon.com Inc., Cisco Systems Inc., Citrix Systems Inc., Dell Technologies Inc., Equinix Inc., Hewlett Packard Enterprise Co., International Business Machines Corp., Juniper Networks Inc., Microsoft Corp., NetApp Inc., Oracle Corp., Rackspace Technology Inc., Salesforce Inc., SAP SE, SS and C Technologies Holdings Inc., Temenos AG, and VMware Inc. |

Market Driver

Financial service institutions are increasingly adopting cloud solutions to enhance their operations and meet the demands of digital transformation. Private cloud solutions offer control and customization, while public cloud solutions provide scalability and agility. Hybrid cloud adoption is on the rise, allowing organizations to leverage both types of solutions. Artificial intelligence and machine learning are key tools in the financial services industry, and edge computing enables faster data processing. Cloud native technologies like containerization and microservices architecture are essential for IT strategies. Operational efficiency and data security are top priorities, with advanced security measures, identity management, and compliance automation ensuring protection. Cloud expertise is crucial for implementing these solutions, addressing regulatory problems and ensuring disaster recovery. With the rise of remote working, digital banking transformation, and increasing internet penetration, cloud computing services are becoming essential for customer acquisition and service delivery. However, cyber attacks and data protection measures are ongoing concerns, requiring cloud computing software and strong encryption.

OpenStack is a popular open-source cloud computing technology, initiated as a collaboration between Rackspace and NASA in 2010. This technology consists of a collection of software tools designed to manage and construct cloud platforms in various environments. Major corporations, including Cisco Systems, Rackspace, Dell, HPE, IBM, Oracle, Red Hat, and VMware, support OpenStack. Its adoption is more prevalent in large financial institutions than in Small and Medium Enterprises (SMEs). These financial institutions predominantly utilize OpenStack for their core banking platforms.

Request Sample of our comprehensive report now to stay ahead in the AI-driven market evolution!

• Financial service institutions in the industry are increasingly adopting cloud solutions to enhance operational efficiency and support digital transformation. Private cloud solutions offer control and customization, while public cloud solutions provide scalability and agility. However, challenges persist, such as security concerns, regulatory problems, and data protection. Hybrid cloud adoption, utilizing both private and public clouds, offers a balance. Advanced security measures like strong encryption, identity management, and compliance automation are essential. AI and machine learning tools, edge computing, and cloud native technologies are driving innovation. IT strategies must balance delivery models, application development, and storage. With increased internet penetration and remote working, digital banking transformation relies on cloud computing services and tools. Cyber attacks demand data security measures. Cloud expertise is crucial to navigate these complexities and ensure customer acquisition and disaster recovery.

• The financial services industry handles significant amounts of sensitive client and customer data, including bank accounts, debit or credit card information, and business transactions. Due to the value of this data, financial institutions are prime targets for cybercriminals. Strict data security standards are essential in this industry due to the potential risks of data breaches and the resulting reputational damage. With increasing data privacy regulations, the demand for data privacy policies is growing. Private and public cloud solutions offer enhanced security features, making them popular choices for financial services organizations seeking to protect their data. These cloud solutions provide encryption, access controls, and regular security updates, ensuring compliance with data protection regulations and safeguarding against cyber threats.

Discover how AI is revolutionizing market trends- Get your access now!

This private and public cloud market in the financial services industry report extensively covers market segmentation by

- Service Type

- 1.1 SaaS

- 1.2 IaaS

- 1.3 PaaS

- Deployment

- 2.1 Public cloud

- 2.2 Private cloud

- Geography

- 3.1 North America

- 3.2 Europe

- 3.3 APAC

- 3.4 South America

- 3.5 Middle East and Africa

1.1 SaaS- SaaS solutions, delivered over the Internet through a subscription model, are increasingly adopted by financial services firms for CRM, wealth management, core banking, accounting, and payroll. These solutions offer shorter implementation times and significant cost savings by eliminating the need for purchasing and managing hardware and software. Vendors like Salesforce.com specialize in SaaS-based CRM and wealth management software, generating substantial revenue. The demand for predictive analysis drives the popularity of SaaS solutions with analytical tools. Public SaaS, known for elasticity and scalability, is gaining traction in financial services due to its simplified access to platform solutions like AI, big data, data analytics, and IoT. In May 2021, Kwipped launched “APPROVE,” a SaaS solution for equipment financing. The wide adoption of SaaS technology will continue to fuel the demand for SaaS solutions, contributing to the growth of the global private and public cloud market in the financial services industry.

Download a Sample of our comprehensive report today to discover how AI-driven innovations are reshaping competitive dynamics

In the Financial Services Industry, Private and Public Cloud solutions have become essential for businesses seeking to optimize their computing resources and enhance their digital transformation strategies. Private cloud solutions offer control, security, and service customization, making them ideal for handling sensitive financial data. In contrast, Public cloud solutions provide scalability and cost savings, enabling institutions to leverage computing power and storage on-demand. Both solutions offer tools for artificial intelligence, machine learning, and edge computing, enhancing data analysis and processing capabilities. Hybrid cloud adoption allows for the integration of both private and public clouds, offering the best of both worlds. Cloud computing services also provide application development tools and storage solutions, driving innovation and efficiency. Internet penetration continues to increase, making cloud solutions increasingly important for financial service institutions to remain competitive.

In the Financial Services Industry, Private and Public Cloud solutions have become essential IT strategies for institutions seeking to enhance computing resources, improve operational efficiency, and ensure data security. Private cloud solutions offer control, customization, and advanced security measures, making them ideal for handling sensitive financial data. On the other hand, Public cloud solutions provide scalability, agility, and cost savings, enabling financial institutions to quickly deploy cloud-native applications and services. Hybrid cloud adoption is gaining popularity, allowing institutions to leverage both private and public clouds for optimal IT strategies. Artificial intelligence (AI) and machine learning (ML) are transforming financial services, requiring massive computing power and data storage. Edge computing is also essential for real-time analytics and low-latency processing. Digital transformation strategies are driving cloud adoption, with internet penetration and the increasing use of mobile phones, tablets, and digital banking transforming the industry. However, regulatory problems and cyber attacks pose significant challenges, necessitating strong encryption, identity management, compliance automation, and cloud expertise. Cloud computing services offer advanced tools for application development, data storage, and analytical support. Virtual computers, containerization, and microservices architecture enable institutions to build cloud-native applications and IT strategies tailored to their unique needs. Disaster recovery and delivery models are also critical considerations for financial services institutions seeking to mitigate risks and ensure business continuity.

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

- Service Type

- SaaS

- IaaS

- PaaS

- Deployment

- Public Cloud

- Private Cloud

- Geography

- North America

- Europe

- APAC

- South America

- Middle East And Africa

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: [email protected]

Website: www.technavio.com/

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/private-and-public-cloud-market-in-financial-services-to-grow-by-usd-106-43-billion-2024-2028-driven-by-big-data-and–ai-influenced-market-trends—technavio-302326186.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/private-and-public-cloud-market-in-financial-services-to-grow-by-usd-106-43-billion-2024-2028-driven-by-big-data-and–ai-influenced-market-trends—technavio-302326186.html

SOURCE Technavio