Massive Investment in Africa Data Center Construction Market by 2028 as Africa Emerges as the Next Frontier of the Global Data Center Market- Arizton

Press Releases

May 09, 2023

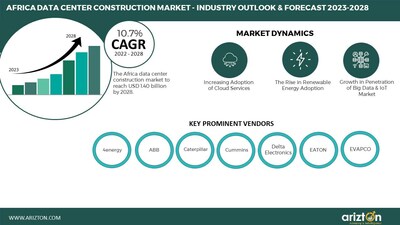

CHICAGO, May 9, 2023 /PRNewswire/ — According to Arizton’s latest research report, the Africa data center construction market will grow at a CAGR of 10.7% during 2022-2028.

To Know More, Download the Free Sample Report: https://www.arizton.com/request-sample/3778

Browse In-Depth TOC on the Africa Data Center Market

29 – Tables

93 – Charts

310 – Pages

Africa is being called the next frontier of the data center industry as large numbers of data centers along with large power capacities are coming up. The data center demand in the region is fuelled by the rise in the adoption of 5G, artificial intelligence, government incentives, and smart city initiatives.

The region is also witnessing cloud investments leading to data center growth. For instance, in April 2022, Kasi Cloud, a cloud-based service provider in the region, opened a data center in Nigeria to expand its services. South Africa is one of the major data center markets witnessing the opening of cloud regions by Google, Oracle, and Amazon Web Services. The region witnessed acquisitions, where the MainOne data center was acquired by Equinix and Teraco by Digital Realty.

Africa Data Center Construction Market Report Scope

|

Report Attributes |

Details |

|

Market Size (2028) |

USD 1.40 Billion |

|

Market Size (2022) |

USD 763.7 Million |

|

CAGR by Revenue (2022-2028) |

10.70 % |

|

Market Size – Area (2028) |

1.21 Million Square Feet |

|

Power Capacity (2028) |

240.5 MW |

|

Base Year |

2022 |

|

Forecast Year |

2023-2028 |

|

Market Segmentation |

Infrastructure, Electrical Infrastructure, Mechanical Infrastructure, Cooling Systems, Cooling Technique, General Construction, Tier Standards, and Geography |

|

Geographic Analysis |

Africa (South Africa, Kenya, Nigeria, Egypt, Ethiopia, and Other African Countries) |

|

Market Dynamics |

· Increasing Adoption of Cloud Services · Growth in Penetration of Big Data & IoT Market · The Rise in Renewable Energy Adoption · Increase in Submarine Cable & Inland Connectivity |

Looking for More Information? Download the Free Sample Report: https://www.arizton.com/request-sample/3778

Investment Analysis

- In April 2022, Airtel Nigeria opened its data center in Nigeria. Kasi Cloud started the construction of the Lagos facility in Nigeria, and Raxio Data Centres started the construction of a data center facility in the Democratic Republic of the Congo and Ivory Cost as part of their expansion in the region.

- In 2022, South Africa was a leader in new investments, followed by Kenya, Nigeria, Egypt, Congo, Ivory Coast, Morocco, Ethiopia, and other African countries.

- In September 2022, Amazon Web Services launched its new service in South Africa, Amazon Workspace, which provides cloud-based services in the region.

- In June 2022, Africa Data Centres announced its plan to expand its presence in Cape Town with a new data center facility. The facility will have eight data halls offering 20 MW of power capacity and is expected to be operational by 2023.

- October 2022: NTT Global Data Centers opened its new data center facility in South Africa. The data center facility “Johannesburg 1 Data Center” has a power capacity of 12 MW with an area of more than 64,583 square feet.

Key Market Participants’ Initiatives

The African data center construction market is witnessing increased demand across industries, and acquisitions & joint ventures enable new players to enter the market, attract customers, and capture a higher market share.

- Equinix expanded its footprint in the region by completing the acquisition of MainOne, including MDX-I, in H1 2022.

- Digital Realty acquired a major stake of around 55% in Teraco.

Colocation Service Providers such as Africa Data Centres, Digital Parks Africa, Raxio Data Centres, IXAfrica, Rack Centre, and Wingu are the major operators in the region. The region is witnessing potential growth through these providers; for instance, Raxio Data Centres is developing around five facilities across Angola, Ethiopia, the Democratic Republic of Congo, Ivory Coast, Mozambique, and Tanzania, expected to be operational during the forecast period.

In 2022, the Africa data center construction market also witnessed the entry of investors like Vantage Data Centers, Airtel Nigeria, Cloudoon, Open Access Data Centres, and Kasi Cloud. For instance, Open Access Data Centres opened more than 20 data center facilities in South Africa and Nigeria.

Customization Available: https://www.arizton.com/customize-report/3778

The report includes the investment in the following areas:

Infrastructure

- Electrical Infrastructure

- Mechanical Infrastructure

- General Construction

Electrical Infrastructure

- UPS Systems

- Generators

- Transfer Switches & Switchgear

- PDUs

- Other Electrical Infrastructure

Mechanical Infrastructure

- Cooling Systems

- Racks

- Other Mechanical Infrastructure

Cooling Systems

- CRAC and CRAH Units

- Chillers Units

- Cooling Towers, Condensers, and Dry Coolers

- Other Cooling Units

Cooling Techniques

- Air-based Cooling

- Liquid-based Cooling

General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Engineering & Building Design

- Fire Detection & Suppression

- Physical Security

- DCIM/BMS Solutions

Tier Standard

- Tier I & Tier II

- Tier III

- Tier IV

Geography

- Africa

- South Africa

- Kenya

- Nigeria

- Egypt

- Ethiopia

- Other African Countries

Major Vendors

Prominent Support Infrastructure Providers

- 4energy

- ABB

- Caterpillar

- Cummins

- Delta Electronics

- EATON

- EVAPCO

- Enlogic

- Legrand

- Master Power Technologies

- Rittal

- Rolls-Royce

- Schneider Electric

- Siemens

- STULZ

- Vertiv

Prominent Data Center Construction Contractors

- Abbeydale

- Advanced Vision Morocco

- ARSMAGNA

- Arup

- Atkins

- b2 Architects

- CAP DC

- Chess Enterprises

- Copy Cat Group

- Eastra Solutions

- Edarat Group

- EDS Engineers

- Egypro

- H&MV Engineering

- Ingenium

- Interkel

- JLB Architects

- MWK Engineering

- Orascom Construction

- Royal HaskoningDHV

- Shaker Group

- Sterling & Wilson

- Summit Technology Solutions

- Tri-Star Construction

- United Egypt

- Westwood Management

Data Center Investors

- 21st Century Technology

- Africa Data Centres

- Digital Parks Africa

- Galaxy Backbone

- icolo.io (Digital Realty)

- IXAfrica

- MainOne

- Medallion Communications

- NTT Global Data Centers

- Paratus Namibia

- Rack Centre

- Raxio Data Centres

- Telecom Egypt

- Teraco (Digital Realty)

- Wingu

New Entrants

- Open Access Data Centres (OADC)

- Nxtra by Airtel

- Cloudoon

- Kasi Cloud

- Vantage Data Center

Why Arizton Research Reports?

- 100% Customer Satisfaction

- 24×7 availability – we are always there when you need us.

- 200+ Fortune 500 Companies trust Arizton’s report.

- 80% of our reports are exclusive and first in the industry.

- 100% more data and analysis.

- 1000+ reports published to date.

Additional Benefit Post-Purchase

- 1hr of free analyst discussion

- 10% of customization

Check Out Some of the Top-Selling Research Reports:

Middle East Data Center Construction Market – Industry Outlook & Forecast 2023–2028: The Middle East data center construction market to reach USD 2.86 billion by 2028. Compass Datacenters, Digital Realty, Infinity, EDGNEX, Global Technical Realty, Quantum Switch, and ZeroPoint DC are new entrants in the Middle East data center construction market.

South Africa Data Center Market – Investment Analysis & Growth Opportunities 2022-2027: South Africa data center market will witness investments of USD 3,228.3 million by 2027. South Africa is the top data center market in Africa. The increase in internet and social media penetration driven by COVID-19, deployment of 5G, improved inland connectivity, and low electricity and land prices make South Africa an attractive market for investors.

Middle East and Africa Data Center Colocation Market – Industry Outlook & Forecast 2022-2027: The Middle East and Africa data center colocation market to reach USD 2.61 billion by 2027. The growth in internet penetration, social media usage, and smart city initiatives drives the market.

Africa Data Center Market – Industry Outlook & Forecast 2022-2027: Africa data center market witnessed investments of USD 5 billion by 2027. The factors driving the growth of the Africa data center market are migration from on-premise to colocation and managed services, growing smart city initiatives, and government support for data centers.

Table of Content

1 RESEARCH METHODOLOGY

2 RESEARCH OBJECTIVES

3 RESEARCH PROCESS

4 SCOPE & COVERAGE

4.1 MARKET DEFINITION

4.2 BASE YEAR

4.3 SCOPE OF THE STUDY

4.4 MARKET SEGMENTS

4.4.1 MARKET SEGMENTATION BY INFRASTRUCTURE

4.4.2 MARKET SEGMENTATION BY ELECTRICAL INFRASTRUCTURE

4.4.3 MARKET SEGMENTATION BY MECHANICAL INFRASTRUCTURE

4.4.4 MARKET SEGMENTATION BY COOLING SYSTEMS

4.4.5 MARKET SEGMENTATION BY COOLING TECHNIQUES

4.4.6 MARKET SEGMENTATION BY GENERAL CONSTRUCTION

4.4.7 MARKET SEGMENTATION BY TIER STANDARDS

4.4.8 MARKET SEGMENTATION BY GEOGRAPHY

5 REPORT ASSUMPTIONS & CAVEATS

5.1 KEY CAVEATS

5.2 CURRENCY CONVERSION

5.3 MARKET DERIVATION

6 PREMIUM INSIGHTS

6.1 KEY HIGHLIGHTS

6.2 SEGMENTAL ANALYSIS

6.3 MARKET TRENDS

6.4 GEOGRAPHICAL ANALYSIS

6.5 KEY MARKET PARTICIPANTS’ INITIATIVES

7 MARKET AT A GLANCE

8 INTRODUCTION

8.1 DATA CENTER SITE SELECTION CRITERIA

8.1.1 KEY

9 MARKET OPPORTUNITIES & TRENDS

9.1 INCREASE IN SMART CITY INITIATIVES

9.2 GOVERNMENT SUPPORT FOR DATA CENTER DEVELOPMENT

9.3 GROWING ADOPTION OF ARTIFICIAL INTELLIGENCE

9.4 MIGRATION FROM ON-PREMISES TO COLOCATION & MANAGED SERVICES

9.5 RISE IN 5G NETWORK CONNECTIVITY AND EDGE DATA CENTER DEPLOYMENTS

10 MARKET GROWTH ENABLERS

10.1 INCREASING ADOPTION OF CLOUD SERVICES

10.2 GROWTH IN PENETRATION OF BIG DATA & IOT

10.3 RISE IN RENEWABLE ENERGY ADOPTION

10.4 INCREASE IN SUBMARINE CABLE & INLAND CONNECTIVITY

11 MARKET RESTRAINTS

11.1 LOW BUDGETS & INVESTMENT CONSTRAINTS IN DATA CENTER DEVELOPMENT

11.2 LOCATION CONSTRAINTS ON DATA CENTERS

11.3 DEARTH OF SKILLED WORKFORCE

11.4 SECURITY THREATS IN DATA CENTERS

12 MARKET LANDSCAPE

12.1 MARKET OVERVIEW

12.2 INVESTMENT: MARKET SIZE & FORECAST

12.3 AREA: MARKET SIZE & FORECAST

12.4 POWER CAPACITY: MARKET SIZE & FORECAST

12.5 FIVE FORCES ANALYSIS

12.5.1 THREAT OF NEW ENTRANTS

12.5.2 BARGAINING POWER OF SUPPLIERS

12.5.3 BARGAINING POWER OF BUYERS

12.5.4 THREAT OF SUBSTITUTES

12.5.5 COMPETITIVE RIVALRY

13 INFRASTRUCTURE

13.1 MARKET SNAPSHOT & GROWTH ENGINE

13.2 ELECTRICAL INFRASTRUCTURE

13.2.1 MARKET OVERVIEW

13.2.2 MARKET SIZE & FORECAST

13.3 MECHANICAL INFRASTRUCTURE

13.3.1 MARKET OVERVIEW

13.3.2 MARKET SIZE & FORECAST

13.4 GENERAL CONSTRUCTION

13.4.1 MARKET OVERVIEW

13.4.2 MARKET SIZE & FORECAST

14 ELECTRICAL INFRASTRUCTURE

14.1 MARKET SNAPSHOT & GROWTH ENGINE

14.2 UPS SYSTEMS

14.2.1 MARKET OVERVIEW

14.2.2 MARKET SIZE & FORECAST

14.3 GENERATORS

14.3.1 MARKET OVERVIEW

14.3.2 MARKET SIZE & FORECAST

14.4 TRANSFER SWITCHES & SWITCHGEAR

14.4.1 MARKET OVERVIEW

14.4.2 MARKET SIZE & FORECAST

14.5 POWER DISTRIBUTION UNITS

14.5.1 MARKET OVERVIEW

14.5.2 MARKET SIZE & FORECAST

14.6 OTHER ELECTRICAL INFRASTRUCTURE

14.6.1 MARKET OVERVIEW

14.6.2 MARKET SIZE & FORECAST

15 MECHANICAL INFRASTRUCTURE

15.1 MARKET SNAPSHOT & GROWTH ENGINE

15.2 COOLING SYSTEMS

15.2.1 MARKET OVERVIEW

15.2.2 MARKET SIZE & FORECAST

15.3 RACKS

15.3.1 BUSINESS OVERVIEW

15.3.2 MARKET SIZE & FORECAST

15.4 OTHER MECHANICAL INFRASTRUCTURE

15.4.1 MARKET OVERVIEW

15.4.2 MARKET SIZE & FORECAST

16 COOLING SYSTEMS

16.1 MARKET SNAPSHOT & GROWTH ENGINE

16.2 CRAC & CRAH UNITS

16.2.1 BUSINESS OVERVIEW

16.2.2 MARKET SIZE & FORECAST

16.3 CHILLER UNITS

16.3.1 MARKET OVERVIEW

16.3.2 MARKET SIZE & FORECAST

16.4 COOLING TOWERS, CONDENSERS & DRY COOLERS

16.4.1 MARKET OVERVIEW

16.4.2 MARKET SIZE & FORECAST

16.5 OTHER COOLING UNITS

16.5.1 MARKET OVERVIEW

16.5.2 MARKET SIZE & FORECAST

17 COOLING TECHNIQUE

17.1 MARKET SNAPSHOT & GROWTH ENGINE

17.2 AIR-BASED COOLING

17.2.1 MARKET OVERVIEW

17.2.2 MARKET SIZE & FORECAST

17.3 LIQUID-BASED COOLING

17.3.1 MARKET OVERVIEW

17.3.2 MARKET SIZE & FORECAST

18 GENERAL CONSTRUCTION

18.1 MARKET SNAPSHOT & GROWTH ENGINE

18.2 CORE & SHELL DEVELOPMENT

18.2.1 MARKET OVERVIEW

18.2.2 MARKET SIZE & FORECAST

18.3 INSTALLATION & COMMISSIONING SERVICES

18.3.1 MARKET OVERVIEW

18.3.2 MARKET SIZE & FORECAST

18.4 ENGINEERING & BUILDING DESIGN

18.4.1 MARKET OVERVIEW

18.4.2 MARKET SIZE & FORECAST

18.5 FIRE DETECTION & SUPPRESSION

18.5.1 MARKET OVERVIEW

18.5.2 MARKET SIZE & FORECAST

18.6 PHYSICAL SECURITY

18.6.1 MARKET OVERVIEW

18.6.2 MARKET SIZE & FORECAST

18.7 DCIM/BMS SOLUTIONS

18.7.1 MARKET OVERVIEW

18.7.2 MARKET SIZE & FORECAST

19 TIER STANDARDS

19.1 MARKET SNAPSHOT & GROWTH ENGINE

19.2 TIER STANDARDS OVERVIEW

19.3 TIER I & II

19.3.1 MARKET OVERVIEW

19.3.2 MARKET SIZE & FORECAST

19.4 TIER III

19.4.1 MARKET OVERVIEW

19.4.2 MARKET SIZE & FORECAST

19.5 TIER IV

19.5.1 MARKET OVERVIEW

19.5.2 MARKET SIZE & FORECAST

20 GEOGRAPHY

20.1 INVESTMENT: MARKET SNAPSHOT & GROWTH ENGINE

20.2 AREA: MARKET SNAPSHOT & GROWTH ENGINE

20.3 POWER CAPACITY: MARKET SNAPSHOT & GROWTH ENGINE

21 SOUTH AFRICA

21.1 MARKET SNAPSHOT & GROWTH ENGINE

21.2 MARKET OVERVIEW

21.3 INVESTMENT: MARKET SIZE & FORECAST

21.4 AREA: MARKET SIZE & FORECAST

21.5 POWER CAPACITY: MARKET SIZE & FORECAST

21.6 SUPPORT INFRASTRUCTURE: MARKET SIZE & FORECAST

22 KENYA

22.1 MARKET SNAPSHOT & GROWTH ENGINE

22.2 MARKET OVERVIEW

22.3 INVESTMENT: MARKET SIZE & FORECAST

22.4 AREA: MARKET SIZE & FORECAST

22.5 POWER CAPACITY: MARKET SIZE & FORECAST

22.6 SUPPORT INFRASTRUCTURE: MARKET SIZE & FORECAST

23 NIGERIA

23.1 MARKET SNAPSHOT & GROWTH ENGINE

23.2 MARKET OVERVIEW

23.3 INVESTMENT: MARKET SIZE & FORECAST

23.4 AREA: MARKET SIZE & FORECAST

23.5 POWER CAPACITY: MARKET SIZE & FORECAST

23.6 SUPPORT INFRASTRUCTURE: MARKET SIZE & FORECAST

24 EGYPT

24.1 MARKET SNAPSHOT & GROWTH ENGINE

24.2 MARKET OVERVIEW

24.3 INVESTMENT: MARKET SIZE & FORECAST

24.4 AREA: MARKET SIZE & FORECAST

24.5 POWER CAPACITY: MARKET SIZE & FORECAST

24.6 SUPPORT INFRASTRUCTURE: MARKET SIZE & FORECAST

25 ETHIOPIA

25.1 MARKET SNAPSHOT & GROWTH ENGINE

25.2 MARKET OVERVIEW

25.3 INVESTMENT: MARKET SIZE & FORECAST

25.4 AREA: MARKET SIZE & FORECAST

25.5 POWER CAPACITY: MARKET SIZE & FORECAST

25.6 SUPPORT INFRASTRUCTURE: MARKET SIZE & FORECAST

26 OTHER AFRICAN COUNTRIES

26.1 MARKET SNAPSHOT & GROWTH ENGINE

26.2 MARKET OVERVIEW

26.3 INVESTMENT: MARKET SIZE & FORECAST

26.4 AREA: MARKET SIZE & FORECAST

26.5 POWER CAPACITY: MARKET SIZE & FORECAST

26.6 SUPPORT INFRASTRUCTURE: MARKET SIZE & FORECAST

27 COMPETITIVE LANDSCAPE

27.1 SUPPORT INFRASTRUCTURE

27.2 CONSTRUCTION CONTRACTORS

27.3 DATA CENTER INVESTORS

28 PROMINENT SUPPORT INFRASTRUCTURE PROVIDERS

28.1 4ENERGY

28.1.1 BUSINESS OVERVIEW

28.1.2 PRODUCT OFFERINGS

28.2 ABB

28.3 CATERPILLAR

28.4 CUMMINS

28.5 DELTA ELECTRONICS

28.6 EATON

28.7 EVAPCO

28.8 ENLOGIC

28.9 LEGRAND

28.10 MASTER POWER TECHNOLOGIES

28.11 RITTAL

28.12 ROLLS-ROYCE

28.13 SCHNEIDER ELECTRIC

28.14 SIEMENS

28.15 STULZ

28.16 VERTIV

29 PROMINENT DATA CENTER CONSTRUCTION CONTRACTORS

29.1 ABBEYDALE

29.1.1 BUSINESS OVERVIEW

29.1.2 SERVICE OFFERINGS

29.2 ADVANCED VISION MOROCCO

29.3 ARSMAGNA

29.4 ARUP

29.5 ATKINS

29.6 B2 ARCHITECTS

29.7 CAP DC

29.8 CHESS ENTERPRISES

29.9 COPY CAT GROUP

29.10 EASTRA SOLUTIONS

29.11 EDARAT GROUP

29.12 EDS ENGINEERS

29.13 EGYPRO

29.14 H&MV ENGINEERING

29.15 INGENIUM

29.16 INTERKEL

29.17 JLB ARCHITECTS

29.18 MWK ENGINEERING

29.19 ORASCOM CONSTRUCTION

29.20 ROYAL HASKONINGDHV

29.21 SHAKER GROUP

29.22 STERLING AND WILSON

29.23 SUMMIT TECHNOLOGY SOLUTIONS

29.24 TRI-STAR CONSTRUCTION

29.25 UNITED EGYPT

29.26 WESTWOOD MANAGEMENT

30 DATA CENTER INVESTORS

30.1 21ST CENTURY TECHNOLOGIES

30.1.1 BUSINESS OVERVIEW

30.1.2 SERVICE OFFERINGS

30.2 AFRICA DATA CENTRES

30.3 DIGITAL PARKS AFRICA

30.4 DIGITAL REALTY

30.5 EQUINIX

30.6 GALAXY BACKBONE

30.7 IXAFRICA

30.8 MEDALLION COMMUNICATIONS

30.9 NTT GLOBAL DATA CENTERS

30.10 PARATUS NAMIBIA

30.11 RACK CENTRE

30.12 RAXIO DATA CENTRES

30.13 TELECOM EGYPT

30.14 WINGU

31 NEW ENTRANTS

31.1 OPEN ACCESS DATA CENTRES

31.1.1 BUSINESS OVERVIEW

31.1.2 SERVICE OFFERINGS

31.2 AIRTEL NIGERIA

31.3 CLOUDOON

31.4 KASI CLOUD

31.5 GOOGLE

31.6 VANTAGE DATA CENTERS

32 REPORT SUMMARY

32.1 KEY TAKEAWAYS

33 QUANTITATIVE SUMMARY

33.1 AFRICA DATA CENTER CONSTRUCTION MARKET

33.1.1 INVESTMENT: MARKET SIZE & FORECAST

33.1.2 INFRASTRUCTURE: MARKET SIZE & FORECAST

33.2 MARKET SEGMENTATION

33.2.1 ELECTRICAL INFRASTRUCTURE: MARKET SIZE & FORECAST

33.2.2 MECHANICAL INFRASTRUCTURE: MARKET SIZE & FORECAST

33.2.3 COOLING SYSTEMS: MARKET SIZE & FORECAST

33.2.4 COOLING TECHNIQUES: MARKET SIZE & FORECAST

33.2.5 GENERAL CONSTRUCTION: MARKET SIZE & FORECAST

33.2.6 TIER STANDARDS: MARKET SIZE & FORECAST

33.3 MARKET BY GEOGRAPHY

33.3.1 INVESTMENT: MARKET SIZE & FORECAST

33.3.2 AREA: MARKET SIZE & FORECAST

33.3.3 POWER CAPACITY: MARKET SIZE & FORECAST

33.4 SOUTH AFRICA

33.4.1 INVESTMENT: MARKET SIZE & FORECAST

33.4.2 INFRASTRUCTURE: MARKET SIZE & FORECAST

33.5 KENYA

33.5.1 INVESTMENT: MARKET SIZE & FORECAST

33.5.2 INFRASTRUCTURE: MARKET SIZE & FORECAST

33.6 NIGERIA

33.6.1 INVESTMENT: MARKET SIZE & FORECAST

33.6.2 INFRASTRUCTURE: MARKET SIZE & FORECAST

33.7 EGYPT

33.7.1 INVESTMENT: MARKET SIZE & FORECAST

33.7.2 INFRASTRUCTURE: MARKET SIZE & FORECAST

33.8 ETHIOPIA

33.8.1 INVESTMENT: MARKET SIZE & FORECAST

33.8.2 INFRASTRUCTURE: MARKET SIZE & FORECAST

33.9 OTHER AFRICAN COUNTRIES

33.9.1 INVESTMENT: MARKET SIZE & FORECAST

33.9.2 INFRASTRUCTURE: MARKET SIZE & FORECAST

34 APPENDIX

34.1 ABBREVIATIONS

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Contact Us

Call: +1-312-235-2040

+1 302 469 0707

Mail: [email protected]

Contact Us: https://www.arizton.com/contact-us

Blog: https://www.arizton.com/blog

Website: https://www.arizton.com/

Photo – https://mma.prnewswire.com/media/2072744/Africa_Data_Center_Construction_Market.jpg

Logo – https://mma.prnewswire.com/media/818553/Arizton_Logo.jpg

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/massive-investment-in-africa-data-center-construction-market-by-2028-as-africa-emerges-as-the-next-frontier-of-the-global-data-center-market–arizton-301819646.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/massive-investment-in-africa-data-center-construction-market-by-2028-as-africa-emerges-as-the-next-frontier-of-the-global-data-center-market–arizton-301819646.html

SOURCE Arizton Advisory & Intelligence