Official Suit Announcement Against California Attorney Robert Yaspan

iCrowdNewswire

Oct 06, 2021

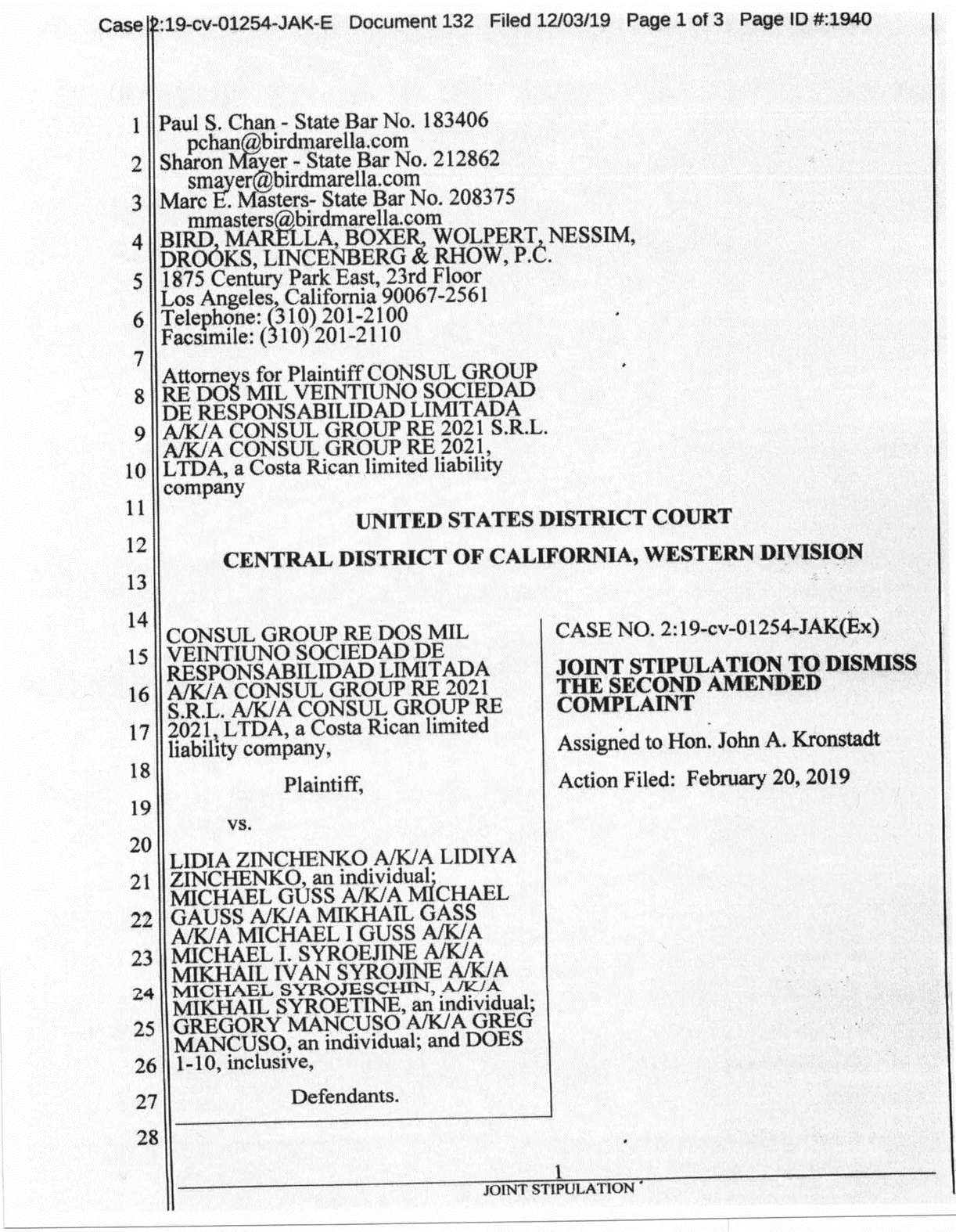

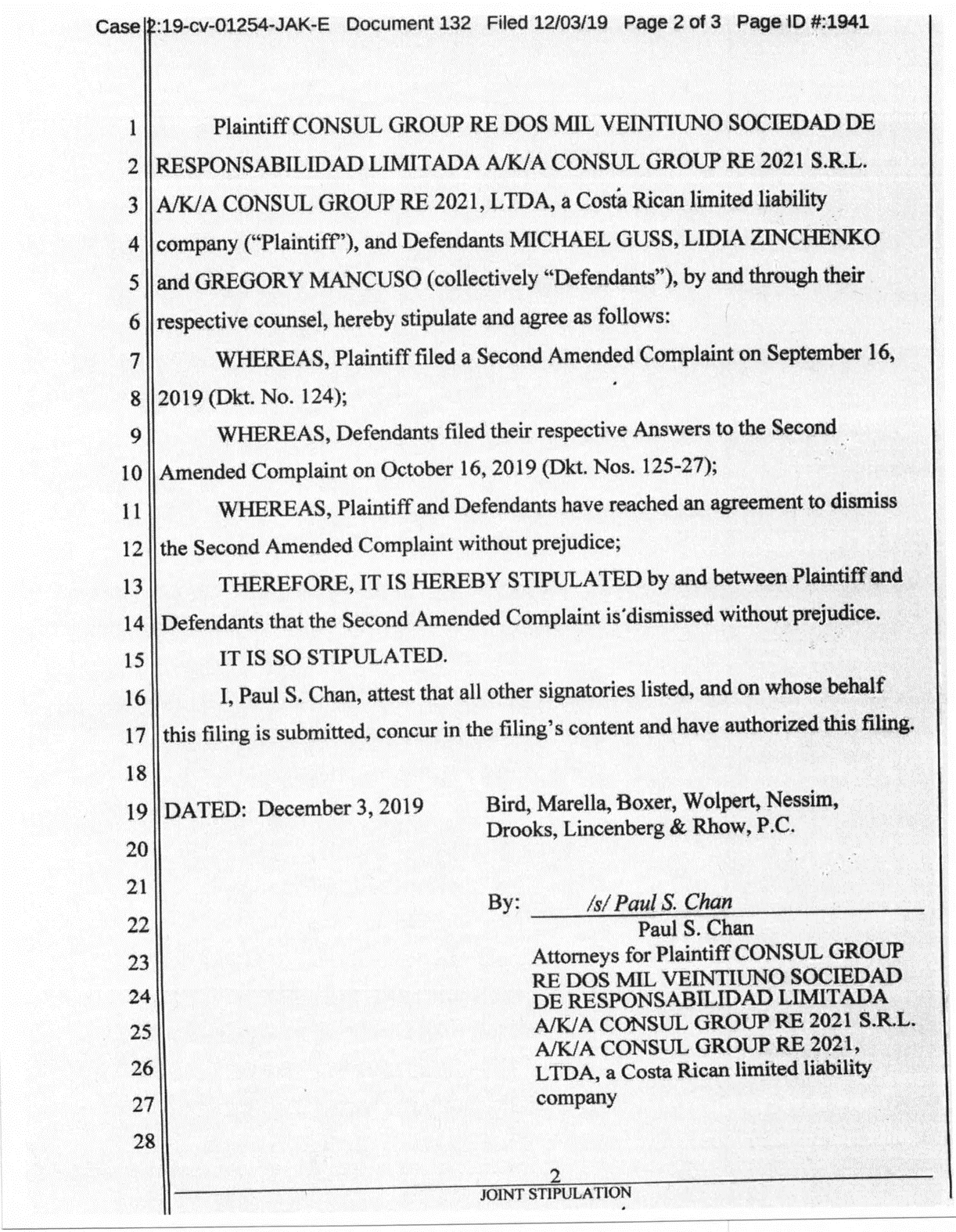

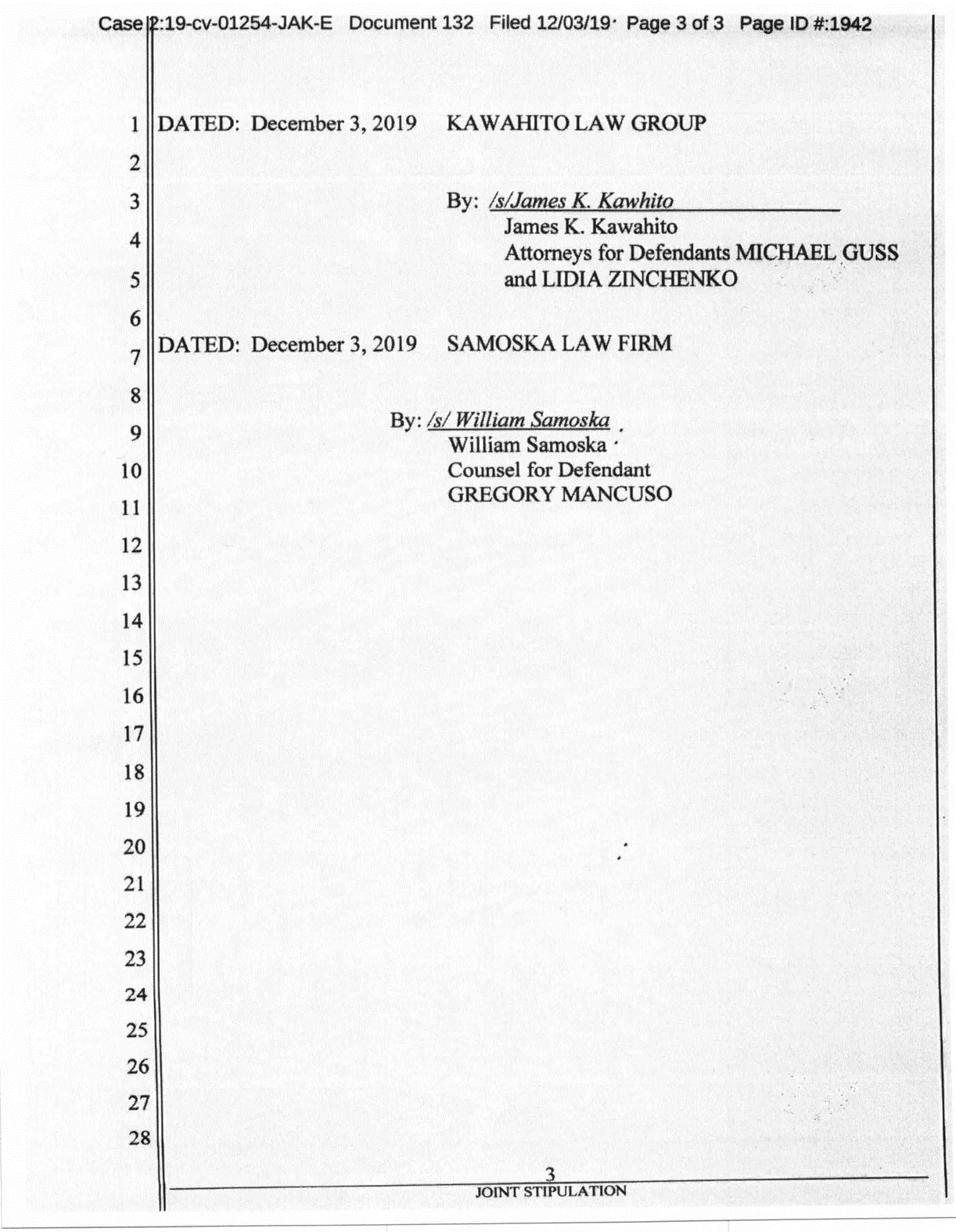

Summary: Corporate Compliance Manager for Rainer AG, Greg Mancuso, has served Dos Mil Veintinuo {Consul Group) with an official lawsuit through the Superior Court of California.

Mancuso alleges that Mo Jacobs AKA Moshe Schnapp was a notorious penny stock manipulator who, among other things, used other defendants as “straw buyers” in order to circumvent security rules.

Body: Santa Monica, California: Corporate Compliance Manager for Rainer AG, Greg Mancuso, has announced a lawsuit through the Superior Court of California against Dos Mil Veintiuno and Mo Jacobs AKA Moshe Schnapp, CEO and alter Ego of Consul Group re Dos Mil Veintiuno.

The lawsuit alleges that Greg Mancuso during his time as a financial consultant of AG Rainer witnessed Moshe Schnapp manipulate penny stocks, among other things, by utilizing other defendants as “straw buyers” – i.e., buyers of stock on behalf of another person to circumvent securities rules.

While Consul Group re Do Mil Veintiuno S.R.L. {“Consul”) is a Costa Rican corporation, all alleged behavior in the suit occurred in the County of Los Angeles. This leaves Schnapp and the other defendants under the legal jurisdiction of California law.

The names of the other defendants are not listed in the suit as their identities were concealed via fictitious names. Names are set to be released when they are ascertained. In the meantime, the suit alleges that the other defendants were owner, co-owners, agents, representatives, partners, or alter egos of their co-defendants.

In the lawsuit it is made clear that as a direct result of the defendant’s conduct, Greg Mancuso and Rainer AG suffered damages in an amount to be proven at trial due to loss of revenue, loss of corporate opportunities, reputational damages and more.

About Rainer AG:

Rainer AG is a brokerage company. Its clients may purchase or sell stocks via their Rainer AG accounts. However, Rainer AG is not a bank and does not hold its customers’ actual stocks. When a customer places an order, the stocks are transferred to and from the deposit accounts at the banks at which they are held by a third-party clearing broker. When a client comes to Rainer with the intention to deposit stocks, Rainer supplies the third party clearing broker with the appropriate documentation and the clearing broker then approves the requested deposit for clearance and transfer. No customers have direct access to either the clearing broker or the stocks or funds managed by Rainer AG.

About Gregory Mancuso:

Gregory Mancuso works as a corporate compliance manager for Rainer AG. Among other responsibilities, he investigates suspicious trade activity and works to ensure that Rainer AG’s activities are in accordance with applicable laws and regulations.